Are you wondering how much professional liability insurance will set you back? You’re not alone.

Many professionals are in the same boat, trying to navigate the world of insurance without breaking the bank. Understanding the cost of professional liability insurance is crucial for protecting your career and financial future. But what does it really cost, and how can you ensure you’re getting the best value for your money?

We’ll uncover the factors that influence your insurance premiums and provide tips to help you make informed decisions. Stay with us to discover how you can safeguard your professional life without overspending.

Factors Affecting Insurance Cost

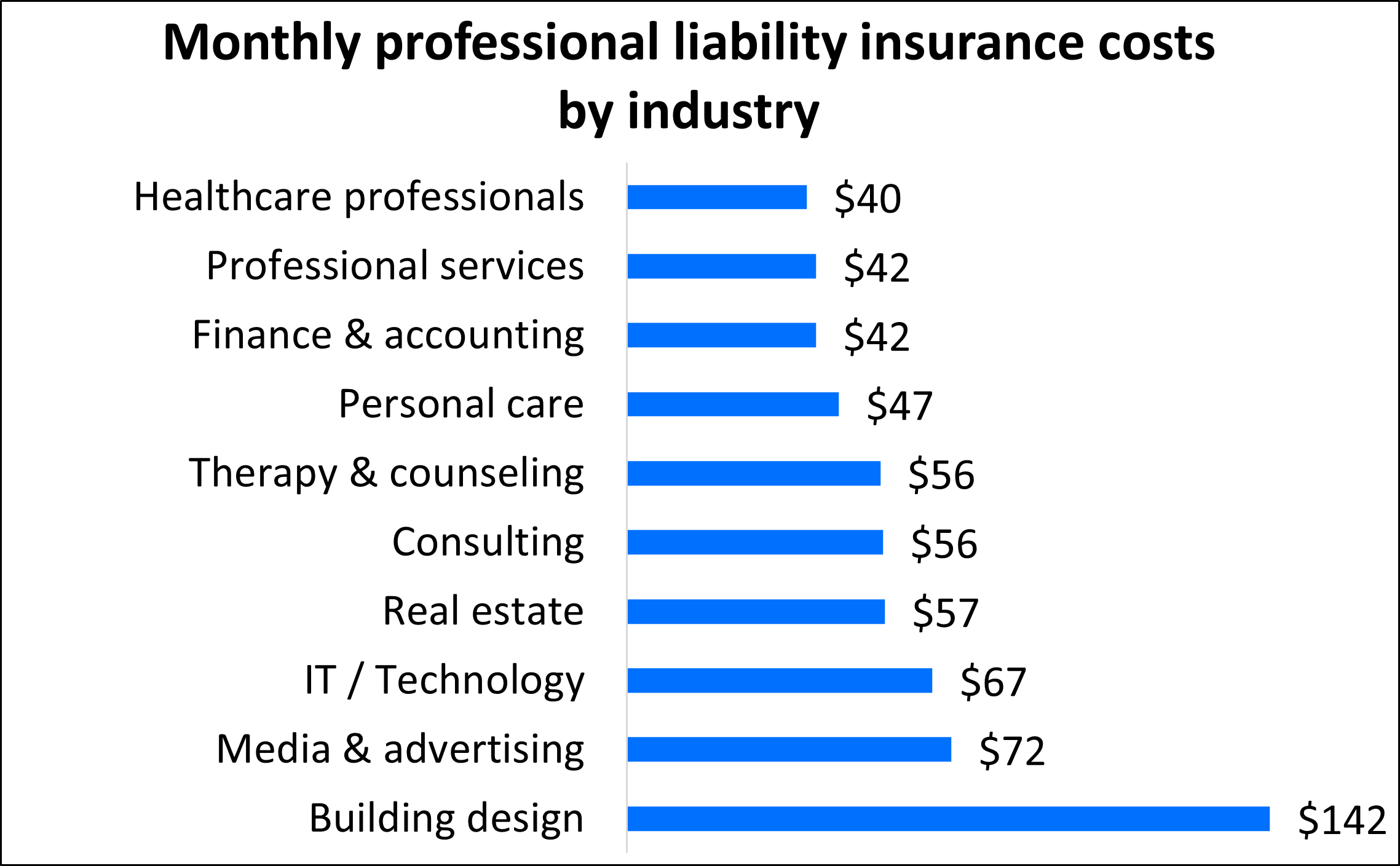

Different industrieshave different risks. A tech company might pay less. A construction firm could pay more. The nature of workinfluences cost. High-risk jobs increase insurance costs. Low-risk jobs reduce them. Each industry has its own cost pattern.

Small businesses usually pay less. Large companies might face higher costs. The number of employeesmatters. More employees can mean more risk. Less employees can mean less risk. Business size affects insurance premiums.

Higher coverage limits lead to higher costs. Lower limits reduce expenses. Choosing the right limit is crucial. More coverage means more safety. Less coverage might be risky. Balancing cost and protection is key.

A history of claimsincreases costs. Few or no claims can lower them. Insurers look at past claims. Frequent claims suggest higher risk. No claims suggest lower risk. History impacts the price of insurance.

:max_bytes(150000):strip_icc()/Liability-insurance_final-1c2c4bbf923b4933b62582d6d006079c.png)

Average Cost Breakdown

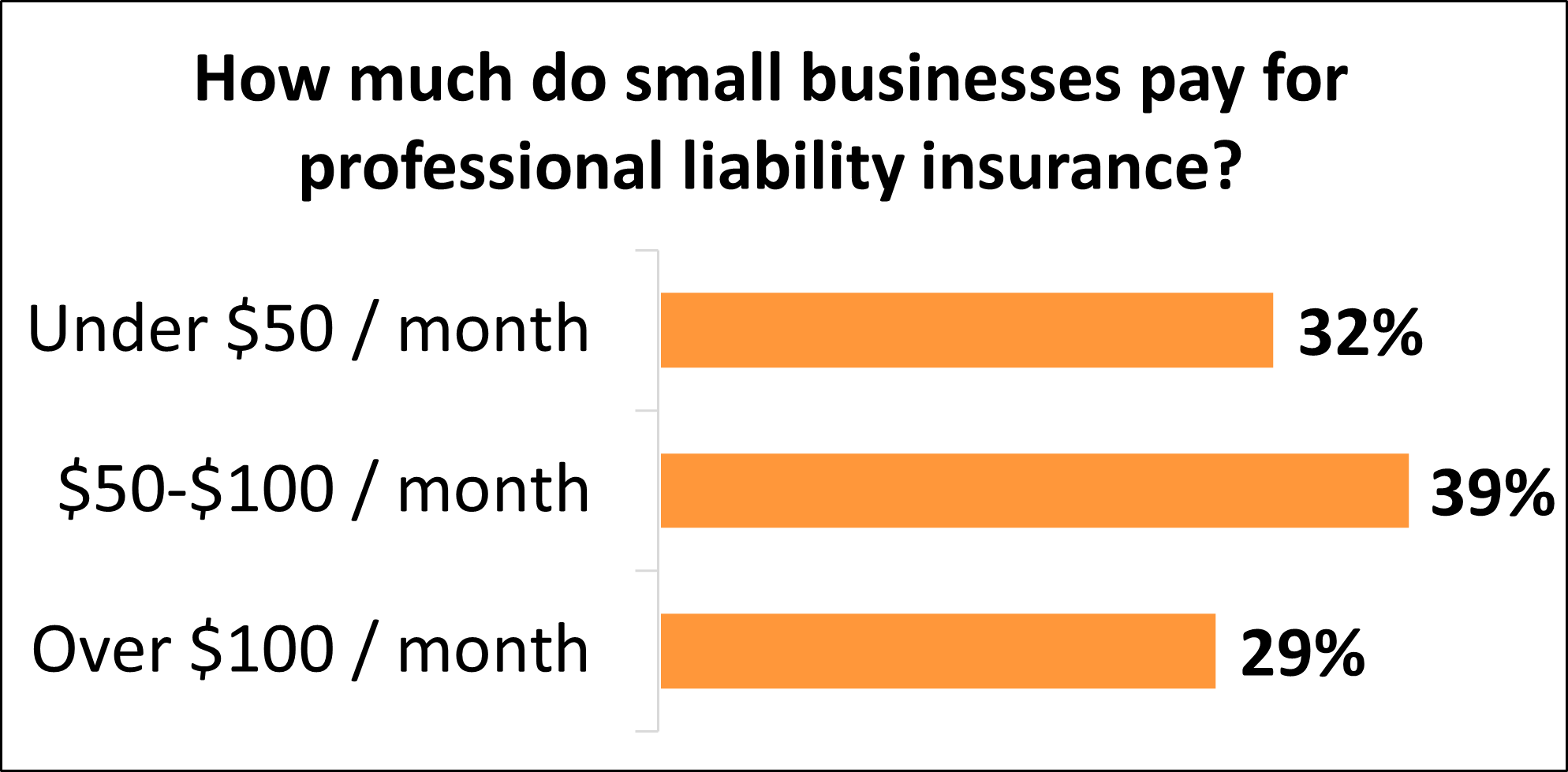

Small businessesoften pay less for insurance. Their risk is usually lower. They might pay around $500 to $1,000 per year. Large businessesneed more coverage. Their cost can be higher. It might reach $5,000 or more annually. Size matters in insurance.

Costs vary by region. Some areas are cheaper. Others have higher rates. Urban areas might be more expensive. Rural areas can be less costly. Location affects insurance prices.

Basic coverageincludes legal protection. It covers mistakes made at work. Some plans have extra options. These might include data breach coverage. Policy choices can change the cost. Choosing the right coverage is important.

Ways To Lower Insurance Premiums

Getting multiple policies from the same company can save money. Bundling means combining different types of insurance. This can be home, auto, or professional insurance. Insurance companies often give discounts for bundles. It makes managing policies easier. It can lead to lower premium costs. Ask your provider for bundle options.

Choosing a higher deductible means paying more upfront if you claim. This can lower your monthly insurance premiums. Higher deductibles mean you take more risk. This can save money over time. Consider if you can afford higher costs in a claim. Talk to your agent about deductible options.

Risk management means reducing the chance of accidents or claims. It includes training staff and checking safety measures. Keep your workplace safe and organized. This can make your insurance company see you as lower risk. Lower risk often equals lower premiums. Regular safety checks can help save money.

Choosing The Right Coverage

Every business has unique needs. Understanding your business risks is key. Do you work in a high-risk industry? Some professions face more lawsuits. Your coverage should match your risk level. Small businesses might need less coverage. Larger businesses often need more. Talk with an expert for advice. They can help you find the right fit.

Providers offer different plans. Compare the costs of each plan. Look for what each plan covers. Some plans have extra benefits. Others might be cheaper but cover less. Check customer reviews too. A good provider should have a good reputation. Don’t just pick the cheapest plan. Make sure it meets your needs.

Every policy has details you must read. Look for exclusions in the policy. These are things the policy won’t cover. Check the limits of the coverage. What is the maximum payout? Is there a deductible? This is the amount you pay before insurance helps. Understanding these details is important. It can save you from surprises later.

Budgeting For Insurance

Insurance is important. It protects your business. But setting financial priorities is key. First, list all your expenses. Decide what is most important. Insurance should be high on the list. It protects against big losses. Small businesses need this safety net.

Divide your budget wisely. Allocate resources for insurance. This ensures you have enough coverage. Save money in other areas if needed. Always keep some funds for unexpected costs. This helps in emergencies. Smart planning keeps businesses secure.

Check your insurance each year. Reviewing coverage is smart. Needs change over time. Businesses grow. Risks can change too. Make sure your policy matches current needs. Adjust if necessary. This keeps you protected. Stay informed and safe.

Common Mistakes To Avoid

Many people think they need less insurance. Professional liability insurance is very important. It covers mistakes that can be costly. Underestimating coverage can lead to big problems. Always check your business risks. Choose the right coverage.

Every policy has exclusions. Exclusions are things not covered by insurance. Ignoring these can be dangerous. Read your policy carefully. Know what is not included. Ask questions if unsure. This helps avoid surprises later.

Some people wait to renew their policy. Delaying renewal can cause gaps in coverage. This leaves you unprotected. Renew on time. Plan ahead and set reminders. This keeps your coverage active and safe.

Frequently Asked Questions

What Affects Professional Liability Insurance Cost?

Several factors influence professional liability insurance costs. These include the type of profession, level of risk, and coverage limits. Your business size and claims history also impact the premium. Customizing your policy to fit your needs can help manage these costs effectively.

How Can I Lower My Insurance Premium?

To lower your professional liability insurance premium, maintain a clean claims history and opt for higher deductibles. Implementing risk management practices and choosing appropriate coverage limits can also help. Regularly reviewing and adjusting your policy can ensure cost-effectiveness.

Is Professional Liability Insurance Tax Deductible?

Yes, professional liability insurance premiums are generally tax-deductible as a business expense. This deduction can help reduce your taxable income. Always consult a tax professional to understand how this applies to your specific situation and ensure compliance with tax regulations.

Do Different Professions Pay Different Insurance Costs?

Yes, different professions face varying levels of risk, influencing their insurance costs. Higher-risk professions typically pay more for coverage. Insurers assess each profession’s exposure to potential claims when determining premiums, ensuring that costs align with the associated risk level.

Conclusion

Understanding professional liability insurance costs is crucial for business planning. It helps manage risks and protect your finances. Costs can vary based on coverage, industry, and risk factors. Research different providers to find the best fit. Compare policies and ensure they meet your needs.

Budgeting for insurance is a wise decision. It safeguards against unexpected claims and legal expenses. Consulting an expert can provide valuable insights. Make informed choices to secure your business’s future. Protect your investment and focus on growth. Insurance is not just a cost; it’s a vital protection.

Read More:

- Top RV Insurance Companies 2025: Best Picks Revealed

- Best Car Insurance Rates 2025: Unlock Savings Now!

- Full‑Time RV Insurance Coverage Options: Maximize Your Protection

- Rv Storage Insurance for Winter: Secure Your Investment

- Affordable Dental Insurance for Seniors: Save Big Now!

- Car Insurance Discounts for Safe Drivers: Unlock Savings

- Best Landlord Property Insurance Plans: Ultimate Guide

- Family Health Insurance Premium Savings: Maximize Your Budget