Have you ever wondered how you can secure your financial future while also enjoying flexibility and growth potential? Indexed Universal Life (IUL) insurance might just be the solution you’re looking for.

Unlike traditional life insurance, an IUL offers you a dynamic blend of life protection and investment opportunities. Imagine having the peace of mind of a life insurance policy, combined with the potential to earn interest based on stock market performance without directly investing in it.

This is not just another insurance product; it’s a strategic financial tool that can work for you in multiple ways. If you’ve ever felt overwhelmed by the complexity of financial planning, you’re not alone. The good news is, understanding the benefits of Indexed Universal Life insurance can be simpler than you think. By the end of this article, you’ll have a clearer picture of how an IUL can be a valuable part of your financial strategy. Curious to find out how this can fit into your life plan? Keep reading to discover the unique benefits that could make a significant difference in your financial wellbeing.

What Is Indexed Universal Life?

Indexed Universal Life is a type of life insurance. It has a cash value that grows over time. This cash value is linked to a stock market index. Policyholders can choose which index they want. The insurance company manages the funds. There is a guaranteed minimum interest rate. This means the value won’t drop below a certain point. This offers protection to your money. Premium payments can be flexible. You can pay more or less depending on your needs. It gives you control over your policy. It’s different from other insurance types because of its growth potential. This growth depends on how the market performs. Indexed Universal Life can be a good choice for those seeking both protection and growth.

:max_bytes(150000):strip_icc()/Pros-and-cons-indexed-universal-life-insurance_final-1b83c0fd52154eb69edd47f99ab8927a.png)

Key Features Of Iul

Choose how much to pay. Pay more when you have extra money. Pay less when times are tough. You decide. This flexibility helps you manage your budget.

Change the amount paid to your family. Increase it for more protection. Decrease it to save money. Adjust as your needs change. Keep your loved ones safe.

Watch your money grow. Cash value grows with interest. It can increase over time. Use it for emergencies or retirement. A valuable resource.

Tax Advantages Of Iul

Indexed Universal Life (IUL) policies offer tax-deferred growth. Your money grows without paying taxes each year. This helps your savings grow faster. You don’t pay taxes until you take the money out. This can be a big advantage.

IUL policies allow tax-free withdrawals. You can take out money without paying taxes. This means more money in your pocket. You can use this money for any need. Like buying a house or paying for college.

The death benefitfrom IUL policies is also tax-free. This means your family gets the full amount. They won’t pay taxes on the money received. This can help your loved ones after you are gone. It provides financial security.

Investment Opportunities

Indexed Universal Life offers a chance to earn index-linked returns. This means your money can grow with the market. The growth ties to a stock market index. But you do not own stocks. This can help your money grow over time. It is a way to build savings. You can watch your money grow safely.

Market downside protection is another benefit. Your money is safe if the market goes down. You won’t lose money when the market falls. This makes it a safe choice for saving. You can feel secure about your money. It protects your hard-earned savings. It is a smart choice for cautious investors.

Risk Management With Iul

The cap rate is the highest return you can get on your policy. Imagine it like a ceiling. If the market grows fast, your policy still stops at the cap. The participation rate shows how much of the market gain your policy earns. If the participation rate is 80%, your policy gets 80% of the market’s gain.

The floor guarantee is like a safety net. Your policy won’t lose money below the floor. Even if the market drops, you have protection. This keeps your savings safe. Feel secure with a floor guarantee.

Enhancing Retirement Income

Indexed Universal Lifecan help with retirement savings. It offers a way to grow money safely. The money grows based on stock market indexes. This means your cash may increase without much risk. You can use this money later for expenses. It helps make retirement more secure.

Accessing cash value is easy. You can take loans from your policy. This means you get money when you need it. You don’t have to pay taxes on these loans. They help during emergencies or big expenses. Cash value grows over time. It helps you have more money when needed.

Iul Vs. Other Life Insurance

Whole Life insurance offers a fixed premium. The policy builds cash value over time. But, growth is often slow. Indexed Universal Life (IUL) offers flexibility. You can adjust premiums and death benefits. The cash value in IUL can grow faster. It links to a stock index.

Whole Life is predictable. IUL offers potential for higher returns. But IUL can be complex. Whole Life is straightforward. Both have their pros and cons. Choose based on your needs.

Term Life insurance is simple. It offers coverage for a set time. If you pass away during this time, your family gets a payout. But, it has no cash value. Once the term ends, so does the coverage.

Indexed Universal Life offers lifetime coverage. It builds a cash value over time. IUL is more expensive than Term Life. But it provides long-term benefits. Term Life is good for short-term needs. IUL offers long-term solutions.

Considerations Before Choosing Iul

IUL policies have different fees and charges. These costs might include administration fees, cost of insurance, and surrender charges. It’s important to know all these costs. They can affect your policy value. Some fees might change over time. Always check the policy documents carefully. Discuss with your financial advisor if needed. This helps avoid surprises in the future.

Think about your personal financial goals. Are you saving for retirement? Maybe you want to leave money for family. Different people have different goals. IUL can help in different ways. But it must fit your needs. Talk to a financial expert. Ensure the IUL aligns with your goals. It can be a useful tool, but only if chosen wisely.

Frequently Asked Questions

What Are The Benefits Of Indexed Universal Life?

Indexed Universal Life (IUL) offers flexible premiums and death benefits. It provides potential cash value growth linked to stock market indices. Policyholders can adjust coverage and premium payments. IUL policies often include tax-free loans against cash value. Additionally, they offer downside protection, ensuring no negative cash value growth.

How Does Indexed Universal Life Insurance Work?

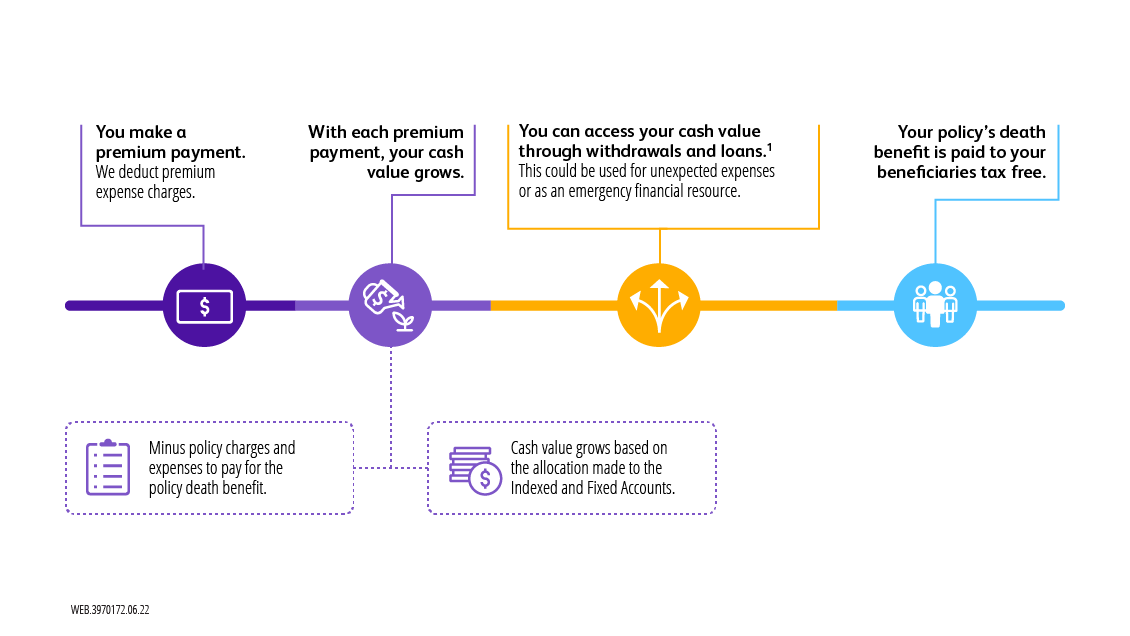

IUL combines life insurance protection with cash value growth. Premiums are allocated between insurance costs and an investment account. The account earns interest based on a stock market index. Policyholders benefit from potential growth without direct market investments. This structure allows for flexibility in managing premiums and death benefits.

Is Indexed Universal Life A Good Investment?

Indexed Universal Life can be a good investment for those seeking flexible insurance with growth potential. It offers tax-deferred cash value accumulation and downside protection. However, it’s essential to consider individual financial goals and risk tolerance. Consulting with a financial advisor can help determine if IUL suits your needs.

Can I Borrow From My Indexed Universal Life Policy?

Yes, policyholders can borrow against the cash value of their Indexed Universal Life policy. Loans are typically tax-free and can be used for various financial needs. It’s important to repay loans to maintain the policy’s benefits. Unpaid loans may reduce death benefits and cash value growth potential.

Conclusion

Indexed Universal Life insurance offers flexible options. It combines life insurance with investment. You choose how to allocate funds. This policy adapts to life’s changes. It provides both security and growth potential. You can adjust premiums or coverage as needed.

Tax advantages are another benefit. An Indexed Universal Life policy suits long-term goals. It supports financial planning and peace of mind. Consider this option for future security and growth. Make informed decisions for your loved ones. Protect them while building wealth.

Choose wisely for a balanced financial future. Stay informed and secure your future today.

Read More:

- Professional Liability Insurance Cost: Essential Budget Tips

- Top RV Insurance Companies 2025: Best Picks Revealed

- Best Car Insurance Rates 2025: Unlock Savings Now!

- Full‑Time RV Insurance Coverage Options: Maximize Your Protection

- Rv Storage Insurance for Winter: Secure Your Investment

- Affordable Dental Insurance for Seniors: Save Big Now!

- Car Insurance Discounts for Safe Drivers: Unlock Savings

- Best Landlord Property Insurance Plans: Ultimate Guide