Are you tired of watching your hard-earned money vanish into the abyss of family health insurance premiums? You’re not alone.

Many families feel the pinch as costs rise, but there’s good news: you don’t have to settle for sky-high rates. Imagine having extra cash for family outings, saving for future dreams, or even just enjoying peace of mind knowing your finances are in order.

The secret lies in understanding how to navigate the world of health insurance to uncover hidden savings. We’re going to dive into practical strategies and smart tips that can help you slash those premiums without compromising on coverage. Ready to discover how to keep more money in your pocket while ensuring your family stays protected? Let’s get started.

Importance Of Family Health Insurance

Family health insurance keeps everyone safe. It covers medical costs for parents and kids. Illness can come anytime. Insurance helps you pay for doctor visits and hospital stays. You never know when someone might need help. This insurance means fewer money worries.

Families feel safe with insurance. It gives peace of mind. You can focus on staying healthy. Preventive care is important too. Insurance can cover vaccines and check-ups. This helps stop problems before they start. Being prepared is smart.

Choosing the right insurance is key. Look for good coverage. Make sure it fits your budget. Talk to an expert if needed. They can explain plans. It’s important to understand what you are paying for. Making smart choices saves money.

Factors Affecting Premium Costs

Older people often pay more for insurance. Young people may get lower rates. Health status also affects costs. Healthy people pay less. Those with health issues might pay more.

More coverage means higher costs. Basic plans cost less. Extra benefits increase premiums. Think about what your family needs. Choose wisely to save money.

Different companies have different prices. Compare offers from several providers. Some companies offer discounts. Special deals can lower your premium. Research is key to finding good prices.

Choosing The Right Plan

Families need different things. Some need extra care for kids. Others need regular check-ups. Parents may want dental or vision coverage. Budget is very important. Think about monthly costs. Know what is covered. Make sure the plan fits the family’s needs. Look at how often you visit the doctor. Consider medicine costs. Health history matters. If someone has special needs, choose carefully.

There are many plans. Each plan offers different things. Some plans have low costs but high deductibles. Others have high costs but cover a lot. List what each plan offers. Check what doctors you can visit. See what hospitals you can go to. Compare the cost of visits and medicine. Look at family doctors and specialists. Find the best fit for your family.

Strategies To Lower Premiums

Choosing a higher deductible can lower your monthly premium. This means you pay more when you need care. But, it saves money each month. Think about your health needs before deciding. If you rarely see a doctor, a higher deductible might work well.

Many insurance companies offer discounts. Some give savings for healthy living. Others offer family discounts. Ask your agent about these options. Compare different plans to find the best deal. Little savings add up over time.

A Health Savings Account (HSA) can help save money. You put money in this account. Use it for medical costs. Tax benefits make it attractive. Save now, spend later. HSAs are smart for unexpected costs.

Leveraging Government Programs

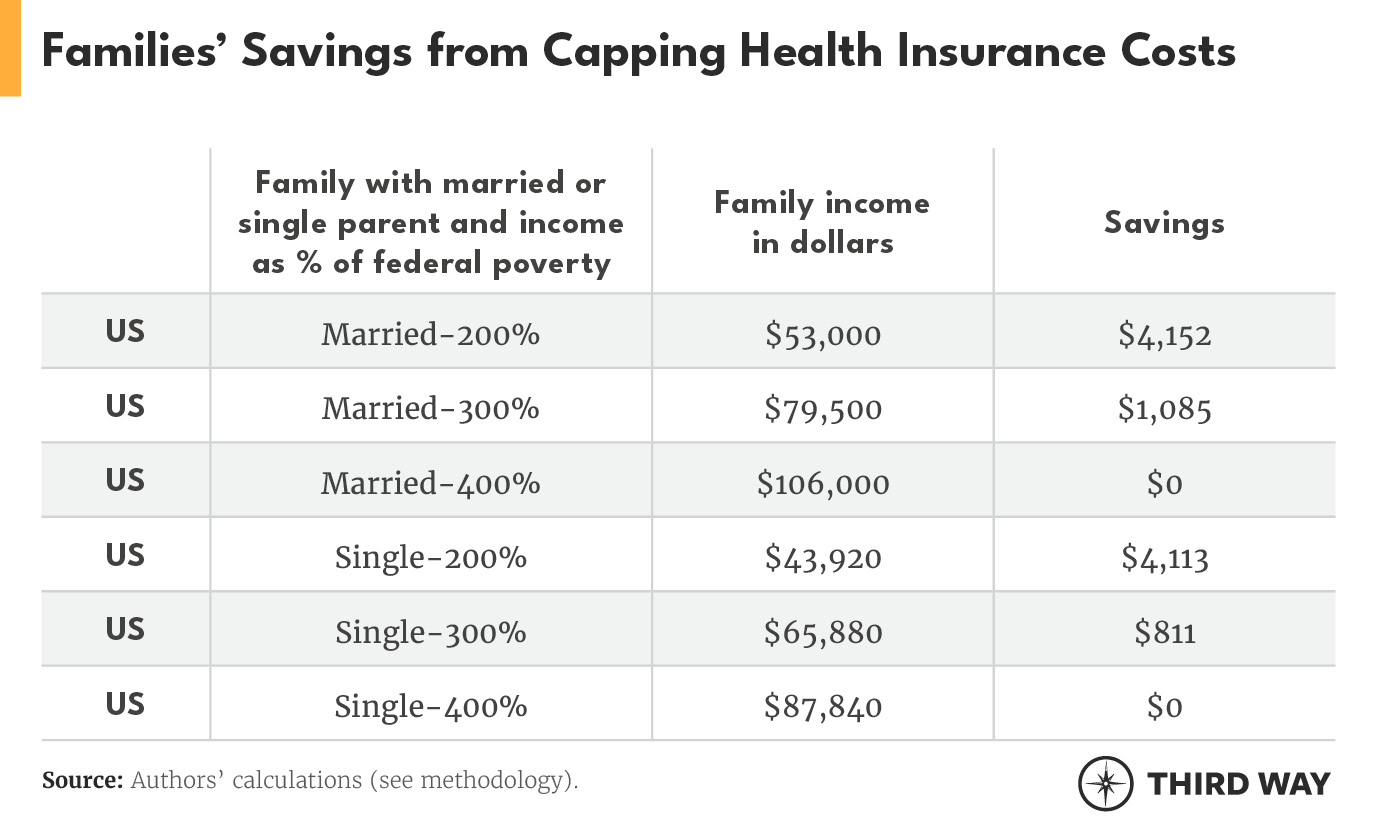

Subsidies help families pay for health insurance. They reduce the monthly premium cost. This makes insurance affordable. Families earning less money get more help. These savings help many families. Use subsidies to save money on health plans.

Medicaid offers free or low-cost health coverage. It is for families with limited income. CHIP stands for Children’s Health Insurance Program. CHIP helps kids get health insurance. Both programs support family health. They cover doctor visits and more. Families can apply anytime. Check if you can use Medicaid or CHIP.

Reviewing And Adjusting Annually

Check if your health plan still fits your family. Look at the costs. See what the plan covers. Compare it with what your family needs. Sometimes, needs change. Make sure the plan still helps. If not, find a better one. It saves money. It keeps your family safe.

Life changes can affect your health plan. New baby? Change jobs? These changes may need plan updates. Update your plan quickly. This keeps you covered. It also saves money. Always check your plan. Make sure it fits your life today.

Common Pitfalls And How To Avoid Them

Many families choose health insurance without checking hidden costs. These costs can surprise you later. You might see low monthly premiums. But, extra fees can add up. Some plans charge high deductibles. Others have copays for doctor visits. These costs are not always clear. Read the policy details carefully. Ask questions if you don’t understand something. This helps avoid surprises. Plan smartly to save money.

People often misjudge their coverage needs. They may pick too little or too much coverage. Too little coverage means paying more out of pocket. Too much coverage means higher premiums. Families should assess their health needs. Think about doctor visits, medications, and hospital stays. Choose a plan that covers your family’s needs. This ensures you don’t pay for unnecessary extras.

Frequently Asked Questions

How Can I Reduce Family Health Insurance Costs?

Reducing family health insurance costs involves comparing plans, increasing deductibles, and utilizing health savings accounts. Regularly reviewing your insurance needs and exploring group insurance options can also help. Additionally, maintaining a healthy lifestyle can lead to lower premiums due to fewer claims.

Are There Discounts For Family Health Insurance?

Yes, many providers offer discounts for family health insurance plans. Discounts can be based on factors like bundling policies, healthy lifestyle incentives, or workplace programs. It’s beneficial to directly ask insurers about available discounts, which may not be prominently advertised.

What Is The Best Way To Compare Health Insurance Plans?

The best way to compare health insurance plans is by evaluating coverage, premiums, and out-of-pocket costs. Consider the network of healthcare providers and benefits specific to your family’s needs. Online comparison tools can simplify this process by providing side-by-side comparisons of different plans.

Do Lifestyle Choices Affect Health Insurance Premiums?

Yes, lifestyle choices significantly impact health insurance premiums. Non-smokers and those with healthy habits often receive lower premiums. Insurers may offer wellness programs and incentives for maintaining a healthy lifestyle, which can further reduce costs and promote overall well-being.

Conclusion

Saving money on family health insurance is within reach. Take small steps. Compare different plans. Look for discounts. Choose a higher deductible if possible. Focus on essential coverage. Keep an eye on your health habits. A healthy lifestyle reduces medical costs.

Regularly review your insurance needs. Make changes when necessary. Remember, a little effort now saves money later. Protect your family and your finances wisely. Prioritize understanding your options. This helps you make informed decisions. Stay proactive with your insurance choices.

Your wallet and family will thank you.

Read More:

- Professional Liability Insurance Cost: Essential Budget Tips

- Top RV Insurance Companies 2025: Best Picks Revealed

- Best Car Insurance Rates 2025: Unlock Savings Now!

- Full‑Time RV Insurance Coverage Options: Maximize Your Protection

- Rv Storage Insurance for Winter: Secure Your Investment

- Affordable Dental Insurance for Seniors: Save Big Now!

- Car Insurance Discounts for Safe Drivers: Unlock Savings

- Best Landlord Property Insurance Plans: Ultimate Guide