Navigating the world of health insurance can feel like solving a puzzle with too many pieces. You’re not alone if you find yourself overwhelmed by the countless individual health insurance plans available.

Each option comes with its own set of benefits, costs, and fine print that can make your head spin. But don’t worry, you’re in the right place. This article will guide you through the maze of choices, helping you compare individual health insurance plans so you can make an informed decision tailored to your needs.

Whether you’re looking for comprehensive coverage or a plan that fits a tight budget, understanding the differences between these plans is crucial. By the end, you’ll feel confident in choosing a plan that safeguards your health and your wallet. Stay with us, because your peace of mind is just a few scrolls away.

Types Of Health Insurance Plans

HMO stands for Health Maintenance Organization. These plans have a network of doctors. You must choose a primary care doctor. All your healthcare goes through this doctor. Specialist visits need a referral from your primary doctor. HMO plans often have lower costs. They cover only in-network care.

PPO means Preferred Provider Organization. These plans offer more flexibility. You can see any doctor without a referral. You save money with in-network providers. But, you can also visit out-of-network doctors. PPO plans often cost more than HMO plans. They are suitable for those who travel often.

EPO stands for Exclusive Provider Organization. These plans are a mix of HMO and PPO. You do not need a referral for specialists. But, you must use in-network providers. EPO plans do not cover out-of-network care. They have lower premiums than PPO plans. You get a balance of cost and choice.

POS means Point of Service. These plans are a blend of HMO and PPO. You need a primary care doctor. Referrals are needed for specialists. You can see out-of-network providers. But, out-of-network visits cost more. POS plans offer more coverage choices. Suitable for those who want flexibility.

Key Features To Consider

Health plans offer different coverage options. Some plans cover only basic care. Others include specialist visits. Emergency care is crucial. Look for plans that cover hospital stays. Preventive care is important too. Vaccines and screenings should be included. Some plans offer mental health support. Check if vision and dental are covered. Always know what each plan includes.

Network providers are doctors and hospitals in your plan. You pay less when using them. Check if your doctor is in the network. Some plans have a large network. Others may be small. Out-of-network care costs more. Always confirm the network size. Accessibility matters. Choose a plan with providers near you. This saves time and money.

Every plan has a premium. This is what you pay monthly. Some premiums are high. Others are more affordable. Deductibles are what you pay before insurance helps. Low premiums often mean high deductibles. Think about your budget. Decide what you can afford. Balancing premium and deductible is key. This helps manage costs wisely.

Evaluating Plan Benefits

Preventive care helps you stay healthy. Plans often include regular check-ups. Vaccinations are also part of this. Some plans cover screening tests too. These tests catch problems early. It’s wise to check what each plan covers.

Prescription drug coverage is important. Some plans cover generic drugs. Others cover brand-name drugs too. Costs can vary. Many plans have a list of covered drugs. This list is called a formulary. Check the formulary before choosing a plan.

Seeing a specialist can be vital. Some plans need a referral from your main doctor. Others let you see specialists directly. Check if the plan covers your needed specialists. This helps avoid surprise costs.

Comparing Costs

Out-of-pocket expenses affect your budget. You pay these costs before insurance covers the rest. Deductibles are a big part. They are the amount you pay first. After you pay the deductible, insurance starts helping. Copayments and coinsurance are two more costs. Copayments are small fees for visits or medicines. Coinsurance is a percentage you pay. This is after the deductible is met.

Copayments are fixed fees. You pay them for doctor visits or drugs. A visit might cost $20. This is separate from other bills. Coinsurance is different. It is a share you pay after meeting your deductible. For example, you might pay 20% of a hospital bill. Insurance pays the rest. Understanding these terms helps you plan better.

Annual limits show the most you pay in a year. Once you reach this limit, insurance covers 100% of costs. This is a safety net. It keeps you from spending too much. Knowing your plan’s limit helps control expenses. Make sure you check these limits before choosing a plan.

Assessing Plan Flexibility

Some health plans need a referral to see a specialist. This means you must visit your primary doctor first. Other plans let you see any specialist without a referral. Choosing the right plan depends on your needs.

Out-of-network care can be costly. Some plans cover it, but others do not. It is important to know if your plan covers care outside its network. Understanding the costs helps in making the best choice.

Many plans now offer telehealth services. This means you can see a doctor online. It is convenient and saves time. Not all plans offer this. Check if your plan includes telehealth benefits.

Reading The Fine Print

Health plans often have exclusions. These are things they do not cover. Always check what is not included. Some plans do not cover dental care. Others might skip vision care. These are important for you to know. You should read the list of exclusions carefully. This helps you avoid surprises later.

Many plans have rules for pre-existing conditions. They may not cover them right away. Some plans have waiting periods. You must wait before coverage begins. This is important for people with ongoing health issues. Always check if your condition is covered. This can save you many problems later.

Health plans often renew each year. You need to know the renewal terms. Will your premium change? What about your benefits? Some plans change their terms yearly. You should review them each year. This ensures your plan still fits your needs.

Tips For Choosing The Right Plan

Start by thinking about your health. Are you often sick or healthy? Knowing your health needs can help you pick the best plan. Check if you visit the doctor a lot or only sometimes. Consider the medicines you take. Some plans cover more medicines. Others might not cover as much.

Look at your family’s health too. Family history is important. If your family has health issues, you may need more coverage. Think about future needs too. If you plan for a baby, you’ll need special coverage.

Lifestyle is important. Active people might need plans with good injury coverage. If you travel a lot, check for travel coverage. Some plans cover health needs in other countries. Food and exercise habits matter too. Healthy living can lower costs.

Experts can help. A health insurance agent knows a lot. They can explain different plans. Doctors can also give advice. They know your health needs best. Friends and family might help too. They can share their experiences with different plans.

Frequently Asked Questions

What Is Individual Health Insurance?

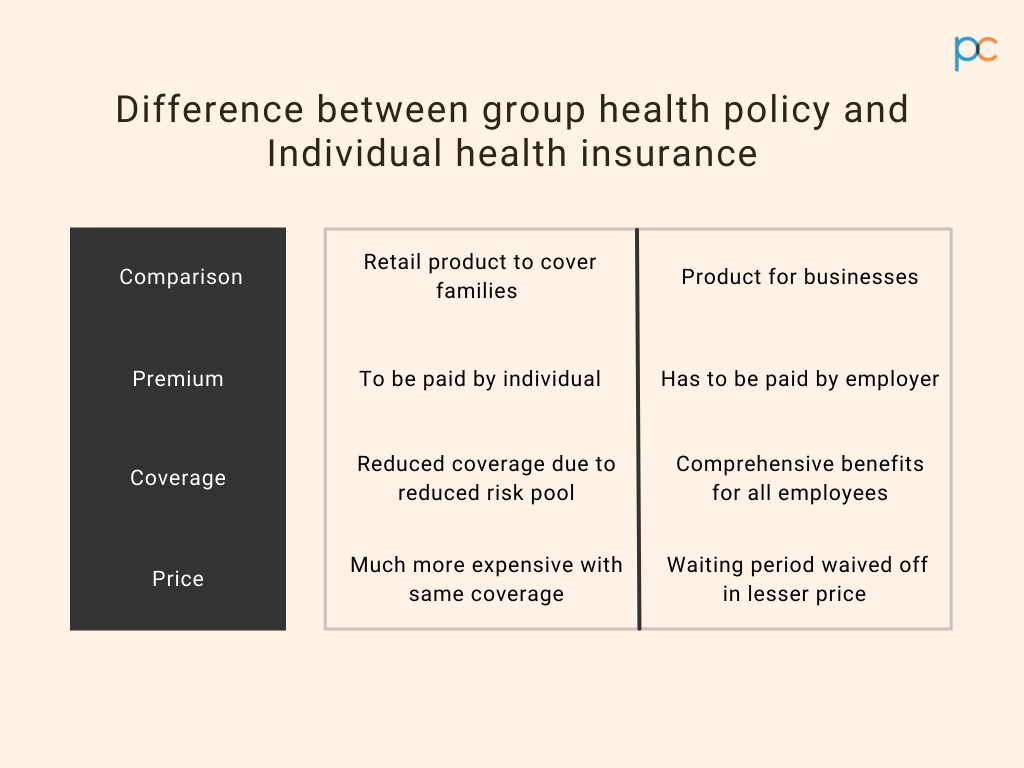

Individual health insurance is a policy you buy for yourself or your family. It provides coverage for medical expenses, including doctor visits, hospital stays, and prescription drugs. Unlike group insurance, it’s not tied to your employer. You can choose plans based on coverage needs and budget.

How Do I Compare Health Insurance Plans?

To compare health insurance plans, consider premiums, deductibles, and out-of-pocket costs. Check the network of doctors and hospitals. Evaluate coverage for prescriptions and specific health needs. Use comparison tools online for a side-by-side view. Always read reviews and check the insurer’s reputation.

What Factors Affect Health Insurance Costs?

Health insurance costs depend on age, location, and coverage level. Your health status and tobacco use can also impact premiums. Higher deductibles often mean lower premiums. Additionally, family size and plan type influence costs. Always review all factors to choose the best plan.

Are All Individual Health Plans The Same?

No, individual health plans vary in coverage and cost. They differ in premiums, deductibles, and out-of-pocket limits. Networks of doctors and hospitals can also vary. Some plans offer more comprehensive coverage, while others focus on basic needs. Always review the details before choosing.

Conclusion

Choosing the right health insurance plan is crucial. Understand your needs and budget. Consider coverage, premiums, and network of doctors. Compare plans side by side. Don’t rush the decision. Take your time to review each option. Ask questions if needed.

This ensures you get the best value. Your health and finances depend on it. With careful consideration, you can find the right plan. Protect yourself and your loved ones. Health insurance is an investment in your future. Make a wise choice today.

Stay informed, stay healthy.

Read More:

- Professional Liability Insurance Cost: Essential Budget Tips

- Top RV Insurance Companies 2025: Best Picks Revealed

- Best Car Insurance Rates 2025: Unlock Savings Now!

- Full‑Time RV Insurance Coverage Options: Maximize Your Protection

- Rv Storage Insurance for Winter: Secure Your Investment

- Affordable Dental Insurance for Seniors: Save Big Now!

- Car Insurance Discounts for Safe Drivers: Unlock Savings

- Best Landlord Property Insurance Plans: Ultimate Guide