Navigating the maze of health insurance can be overwhelming, especially when you’re considering short-term options. You’re not alone in wondering if short-term health insurance is a viable solution for your coverage needs.

The cost can often be a deciding factor. That’s why understanding the ins and outs of short-term health insurance costs is crucial. Imagine having peace of mind knowing exactly what you’re paying for and why. This guide is designed to help you uncover the hidden costs, the benefits, and the potential savings that could make a significant difference in your decision-making process.

Stay with us, and by the end of this article, you’ll have a clear picture of whether short-term health insurance is the right fit for your budget and lifestyle.

Benefits Of Short-term Health Insurance

Short-term health insurance is often a quick and affordablechoice. It helps when you need coverage for a short period. This insurance offers flexible optionsto fit your needs. You can choose plans for a few months. This is helpful for many people. If you lose your job, it can be a great option. It covers emergency visitsand some doctor appointments. It does not cover everything but can be useful. Costs are usually lowercompared to long-term plans. Many find it helpful between jobs or during life changes.

Some plans provide prescription drug coverage. It is important to check what each plan covers. You can find plans with different prices. Each person can pick what suits them best. It’s important to read the details before choosing. This ensures you get the coverage you need. Short-term insurance can ease worries during uncertain times. It offers a safety net without high costs.

Factors Influencing Cost

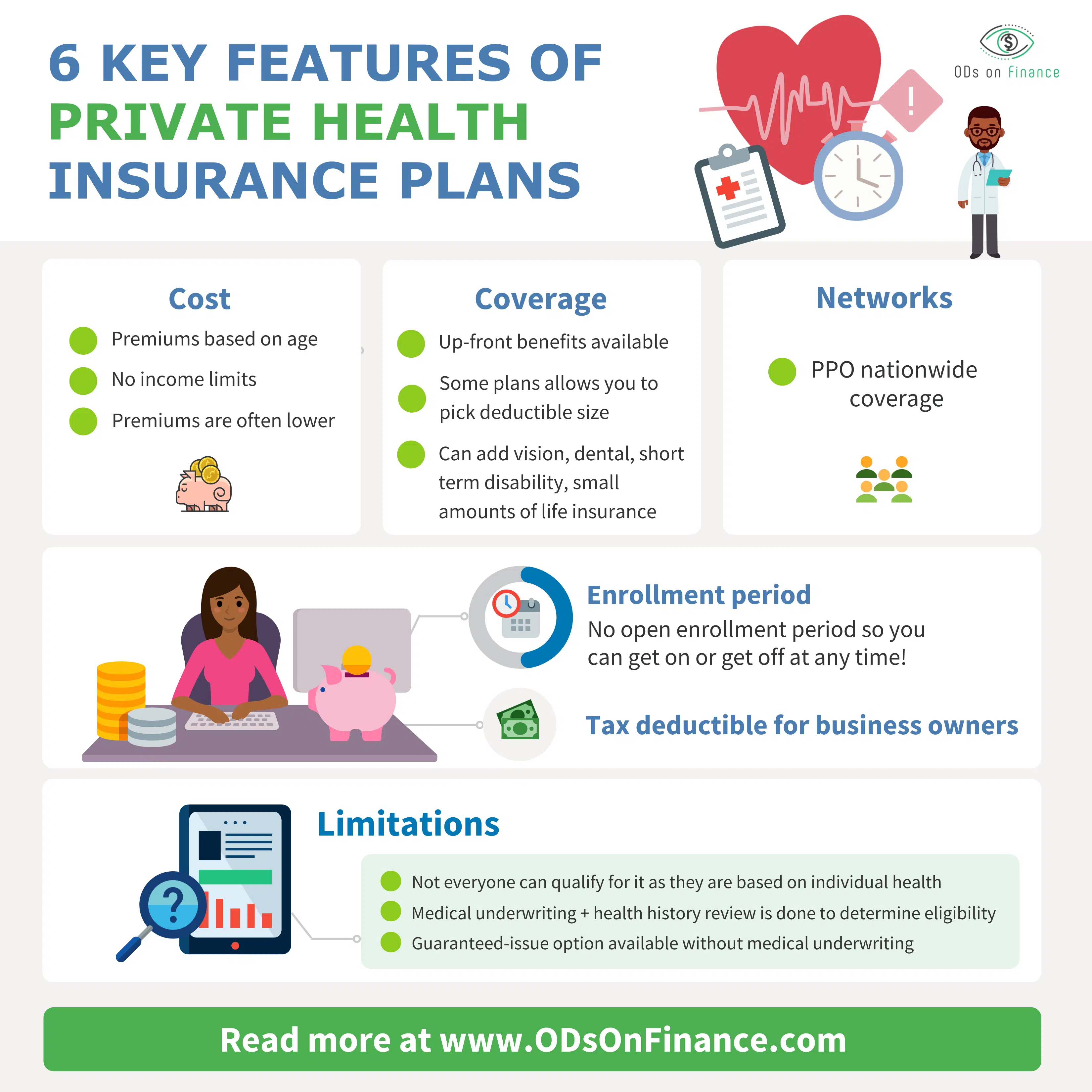

Younger people often pay less for insurance. Age impacts the cost a lot. If someone is older, the price can be higher. Health status also plays a big role. People with health problems may pay more. A healthy person might get a lower rate. Being fit can save money on insurance costs.

Shorter plans can be cheaper. But they might not cover much. Longer plans usually cost more. Yet, they offer better coverage. Choosing the right length is important. It affects both cost and protection. People should decide based on their needs.

Plans with more benefits might cost more. But they give more protection. Limits can also change the price. A plan with high limits might cost more. Yet, it can cover more if needed. People must balance cost with coverage. It’s wise to check benefits and limits before buying.

Comparing Short-term Vs. Traditional Plans

Short-term plans usually have lower premiums. This means monthly costs are less. But deductibles might be higher. People pay more when they need care. Traditional plans often have higher premiums. Deductibles might be lower. People pay less when they visit a doctor.

Short-term plans cover fewer services. Some visits or treatments might not be included. Networks are smaller. People might have to travel far for care. Traditional plans offer broader coverage. More services are included. Networks are often larger. Care is closer and easier to access.

Short-term plans are flexible. People can enroll any time. These plans last a few months. Traditional plans have set enrollment periods. People must wait for these times to sign up. Plans often last one year. Short-term insurance offers quick solutions but may lack long-term security.

Tips For Reducing Premiums

Higher deductibles can lower your premiums. You pay more out-of-pocket first. After that, insurance helps cover costs. It saves money if you don’t visit the doctor often. Think about your health needs. Make sure you can pay the deductible when needed.

Focus on basic coverage options. This includes doctor visits and emergencies. Avoid extra benefits that aren’t necessary. This keeps your plan simple and cheaper. Always check what is included. Make sure it meets your basic needs.

Look for insurance discounts. Some companies offer family deals. Others give savings for healthy living. Always ask your provider about offers. Compare different plans to find the best deal. Choose the one that fits your budget.

State Regulations Impact

State rules change health insurance terms. Some states allow shorter plans. Others offer longer coverage. Policy terms can be very different. This means you must check the rules in your state. Always know what your policy covers.

States have different consumer protection laws. Some states offer more protections. This keeps you safer from unfair practices. Always read the fine print in your insurance plan. Know your rights as a buyer.

Common Misconceptions

Many people think short-term insurance covers everything. It does not. There are gaps. Some plans do not cover maternity care. Others might skip prescription drugs. It’s important to read your plan. Know what it covers. Know what it does not cover. This helps avoid surprises. If you need more, ask for help. A professional can explain the details.

Some believe these plans last forever. They do not. Short-term plans are temporary. Most last a few months. You cannot always renew them. Some states allow renewals. Others do not. Always check the rules. Rules change from place to place. Sometimes, you must find a new plan. Make sure to stay informed.

Making An Informed Choice

Understanding your health needs is vital. Think about your current health. Do you visit the doctor often? Are you on regular medications? Consider these factors seriously. Short-term health plans may not cover all expenses. Some only cover major medical events. If you only need basic coverage, it might work. But, if you have more needs, think twice. Compare different plans carefully. Ensure they match your personal health requirements. Always read the fine print. Know what is included and what is not. This helps prevent surprises later.

Consulting experts can be helpful. They know the insurance market well. They can explain different plans easily. They help understand the terms clearly. Ask questions about coverage limits. Inquire about premium costs. Discuss any hidden fees. Experts provide clear answers. They guide you to the best choice. Consider their advice seriously. It can save time and money. Make sure to find a trusted advisor. Their knowledge is valuable. They help you make informed decisions.

Frequently Asked Questions

What Is Short-term Health Insurance?

Short-term health insurance offers temporary coverage for unexpected medical needs. It typically lasts from a few months to a year. This type of insurance is ideal for those between jobs or waiting for other coverage. It’s important to note that short-term plans may not cover pre-existing conditions.

How Much Does Short-term Health Insurance Cost?

Short-term health insurance premiums vary based on age, location, and coverage level. On average, monthly premiums can range from $50 to $200. These plans often have higher out-of-pocket costs compared to standard health insurance. It’s essential to compare different plans to find the best fit for your budget.

What Does Short-term Health Insurance Cover?

Short-term health insurance typically covers emergency care, hospitalizations, and some outpatient services. However, it often excludes maternity, mental health, and preventive care. Coverage details vary by provider and plan. Always read the policy’s fine print to understand the specific benefits and limitations before purchasing.

Is Short-term Health Insurance Worth It?

Short-term health insurance is worth it for those needing temporary coverage. It provides basic protection at a lower cost. However, it’s not a substitute for comprehensive plans. Evaluate your healthcare needs and compare options to determine if it aligns with your situation.

Conclusion

Short-term health insurance offers flexible options for temporary coverage. It’s crucial to compare plans carefully. Consider monthly premiums, deductibles, and co-pays. Understanding these costs helps you make informed decisions. Each plan varies in price and benefits. Some plans may suit your needs better than others.

Evaluate your healthcare needs and budget closely. This approach ensures you choose the right plan. Short-term insurance isn’t a one-size-fits-all solution. It serves specific situations and needs well. Make sure your chosen plan aligns with your goals. Always read the policy details thoroughly before committing.

Choose wisely for peace of mind.

Read More:

- Professional Liability Insurance Cost: Essential Budget Tips

- Top RV Insurance Companies 2025: Best Picks Revealed

- Best Car Insurance Rates 2025: Unlock Savings Now!

- Full‑Time RV Insurance Coverage Options: Maximize Your Protection

- Rv Storage Insurance for Winter: Secure Your Investment

- Affordable Dental Insurance for Seniors: Save Big Now!

- Car Insurance Discounts for Safe Drivers: Unlock Savings

- Best Landlord Property Insurance Plans: Ultimate Guide